12 of the Best College Student Credit Cards for 2026

The best student credit cards will help you get ready for the financial world. The goal of getting a credit card as a student isn’t to splurge on items you don’t need, but instead, to learn how they build your credit score.

College student credit cards are designed to help newbies with credit. You need to prepare for them now by establishing an excellent credit profile with a history of making timely debt payments. That way, it will increase your chances of approval for these loans upon graduation.

12 Best College Student Credit Cards

There is no better way to start building a credit profile than to apply for a student credit card. It comes with several perks, including bonuses and lower fees. All you need to do is figure out which student credit card is right for you.

Below are the top 12 best college student credit cards that you can apply for.

1) Capital One Savor Student Cash Rewards Credit Card

The Capital One Savor Student Cash Rewards Credit Card makes the top of the list for

a reason. It is a popular card amongst students because they can receive up to 3%

unlimited cash back on common student purchases, such as groceries, restaurants,

entertainment, and even subscriptions to streaming services. These categories

represent the most common expenses for college students.

What is even more impressive is that you can earn up to 8% cash back when you

purchase and book entertainment services through the Capital One Entertainment

portal. So, any college student serious about their entertainment will definitely want to

consider applying for this card. It also offers 5% back on hotel and rental car bookings

made through Capital One Travel.

New enrollees are eligible for a $50 introductory offer if they spend $100 within the first

three months of opening their credit card account. There is no annual fee for having the credit card either. Between the cost savings and bonus offerings, the Capital One Savor Student Cash Rewards Credit Card is the best choice for any budget-conscious college student.

2) Discover It Student Cash Back

The Discover It Student Cash Back Credit Card is ideal for college students seeking the

maximum rewards possible for their credit card purchases. It offers up to 5% cash back

on common purchases, such as grocery stores and restaurants. There is a $1,500

maximum spending limit per quarter, but you receive 1% unlimited cash back on all

other purchases each quarter.

The most impressive feature is the Unlimited Cashback Match opportunity, where

Discover will pay you double the cash rewards you earned during your first 12 months

of using the card. For instance, if you earned $60 cash back during your first 12 months, Discover will pay you $120 in cash rewards as part of their cashback match offer.

3) Discover It Student Chrome

Busy students may appreciate what the Discover It Student Chrome can offer them.

How would you like to earn up to 2% cash back on up to $1,000 in total purchases at

restaurants and gas stations each quarter?

That is what you can earn with the Discover It Student Chrome Credit Card, along with 1% cash back on all other purchases.

Similar to the Discover Student Cash Back Credit Card, the Cashback Match promotion is also available with the Discover It Student Chrome Credit Card. It will match all your spending to double your cash rewards, such as turning $40 of rewards into $80 at the end of the year.

4) Bank of America Travel Rewards Credit Card for Students

Are you a student who loves to travel? The Bank of America Travel Rewards Credit

The card is designed specifically for students who enjoy spending some time away from their dorms. This card offers 1.5 rewards points on every dollar you spend, regardless of the type of purchase you make. You can redeem these points to help cover common travel expenses, such as airfare, hotels, and ground transportation.

Book your travel arrangements through the Bank of America Travel Center to earn a

stunning three points per dollar. New enrollees will receive 25,000 bonus points once

they spend at least $1,000 on the credit card within the first 90 days. That would

certainly pay for many adventures!

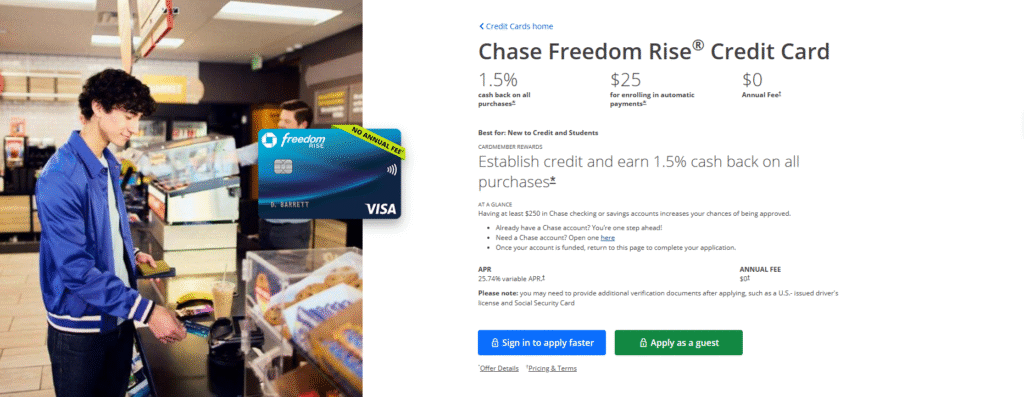

5) Chase Freedom Rise

The Chase Freedom Rise Credit Card is great for students who don’t have a credit

history because you don’t need one to apply. The card is meant to help you establish a credit profile if you don’t already have one, with chances for credit limit increases every six months. You will earn 1.5% cash back on every purchase without paying an annual fee. If you set up automatic payments for your premiums within the first 90 days, you will be eligible to receive a $25 credit bonus.

6) Capital One Quicksilver Student Cash Rewards Credit Card

Would you prefer a simple rewards credit card that is easy to calculate? The Capital

One Quicksilver is a flat-rate rewards credit card that can earn you 1.5% unlimited cash back on all purchases. If you spend $100 within the first 90 days, you will receive a $50 cash bonus reward. There are no foreign transaction fees, no annual fees, or any other hidden fees. So, if you happen to travel outside of the United States and make purchases in another country, you won’t have to worry about those expensive foreign transaction fees like you would with other cards.

7) Firstcard Secured Credit Builder Card

The Firstcard Secured Credit Builder Card is a secured credit card designed for

students without a credit history, including international students from abroad studying in the United States. Since no credit check or social security number is required, both domestic and international students can qualify for the credit card. All you need to do is put down a deposit, which can earn you interest.

Firstcard charges an annual membership fee of between $72 and $144, depending on the type of subscription you have. It is worth paying the fee if you are an international student or need to establish a credit profile for yourself.

8) The Secured Self Visa Credit Card

The Secured Self Visa Credit Card is another excellent secured credit card, offering a

0% annual fee for the first year, followed by a $25 annual fee for every subsequent year. You must pay a minimum security deposit of $100 to open the account. No credit check or credit history is required.

Are you unable to afford the $100 security deposit? If so, you have the option to open a Credit Builder Account for $25 per month. This account will essentially provide you with a loan to cover the security deposit, allowing you to start building your credit history without having to pay the security deposit upfront out of your own pocket.

9) Discover It Secured Credit Card

Many people consider the Discover It Secured Credit Card to be one of the top secured credit cards for college students. Although it requires a minimum-security deposit of $200, it is fully refundable after you have made your payments.

Meanwhile, you can enjoy up to 2% cash back on purchases at restaurants and gas

stations ($1,000 maximum in combined purchases per quarter). It also offers a 1%

unlimited cash back on all other purchases made with this card. Discover Unlimited

Cashback Match will match your cashback rewards during the first year with no

minimum or maximum limits.

10) Grow Credit Mastercard

The Grow Credit Mastercard is a straightforward credit card for establishing a solid

credit history. It does not require you to undergo a hard credit check or make a security deposit. The card won’t even charge you interest payments. Why is that?

The Grow Credit Mastercard is unlike other credit cards because it doesn’t allow you to carry a credit balance. You can only use the card to pay for eligible subscription

services, such as Spotify and Netflix. There is also an annual membership fee that must be paid.

If you cannot get approved for a regular credit card, the Grow Credit Mastercard can be the first step toward building sufficient credit. Eventually, you will be able to get approved for a traditional card.

11) Bank of America Customized Cash Rewards Credit Card for Students

Bank of America’s Customized Cash Rewards Credit Card gives students the power to

earn up to 3% cash back on purchases in any category of their choice, such as

drugstores, travel, home improvement, and e-commerce. You can also earn up to 2%

cash back on purchases at wholesale clubs and grocery stores, along with 1% cash back on all other purchases.

The 3% and 2% cash back rates apply to a combined maximum purchase amount of

$2,500 per quarter. You can still earn the 1% on all other purchases beyond this. Plus,

there is a $200 online cash rewards promotion paid if you spend at least $1,000 within

the first three months.

12) Bank of America Unlimited Cash Reward Credit Card for Students

Do you enjoy unlimited cash rewards? This Bank of America Unlimited Cash Reward

credit card is what you have always been looking for. It offers 1.5% unlimited cash

back on every purchase, with no category restrictions. You also get $200 cash back

after spending $1,000 within 90 days. There is even 0% APR for the first 15 months,

making it the perfect time to make big purchases, such as a high-quality laptop for your college classes.

The Verdict

Overall, the Capital One Savor Student Cash Rewards Credit Card is ideal for college students, as it offers 3% to 8% cash back and provides a $50 introductory bonus. Hence, if you are looking for the best college student credit cards, consider this one!